Banking and Financial Services Reporting and Data Analytics

Get more out of your data. Our financial analytics consulting services uncover new data insights, delivering the information you need to power strategic decisions. Discover the power that lies within your data.

Unveiling Financial Data Insights

In banking, everything counts towards your bottom line.

That’s why you need better visibility into your data, like loan-to-deposit ratio and deposit growth. These and other financial data insights help you improve the way you manage liquidity, analyze borrower risk, and make lending decisions. When you do these things right, you minimize risk and maximize profitability.

How can you get better visibility into your data? With data analytics—and our help.

We equip banks with enterprise-class analytics, unifying data from various platforms into a single, actionable environment, where you can access the data-driven insights you need to make informed decisions that lead to positive outcomes.

Where are you struggling?

We can help with that.

Customized Banking Data Integration Solutions

Our customized banking data integration solutions seamlessly blend diverse data sources, such as net interest margin (NIM), non-performing loan (NPL) ratio, and credit risk exposure, into an all-in-one snapshot so you can easily tap into your complete dataset for more informed decision-making.

Customized Banking Data Integration Solutions

Executive Dashboards in Banking

Executive dashboards in banking give you access to concise, easy-to-understand insights about key performance indicators and critical metrics. With financial data intelligence at your fingertips, you can make more informed decisions, more quickly. For interactive dashboards curated to each of your department’s needs, just ask. You define them, and we build them.

Executive Dashboards in Banking

Enabling Higher Loan Activity

Our tailored analytics empower banking leaders to proactively track loan performance. We put rich financial data insights within reach so you can better analyze borrower risk and make more strategic lending decisions to enable higher loan activity while minimizing risk and improving profitability.

Enabling Higher Loan Activity

Meeting Regulatory Compliance

We consolidate data from disparate sources and platforms into one actionable environment. Given access to streamlined data integration, banks can more confidently ensure collateral isn’t reused across loans to reduce your risks of complications and simplify regulatory compliance.

Meeting Regulatory Compliance

Seamless Data Integration Across Leading Banking and Financial Services Platforms

We integrate data sources from any platform building a unified and comprehensive data environment. This integration empowers banking and financial services organizations to harness the full potential of their data for informed decision-making.

LeapFrogBI helped us save money and time. We were pulling data manually with no insight. Now we are getting a clear picture, we have analysis, and know where we are spending too much time.”

-JUSTIN WESBROOKS, VP BUSINESS SERVICES MANAGER, CENTENNIAL BANK

Reporting Examples

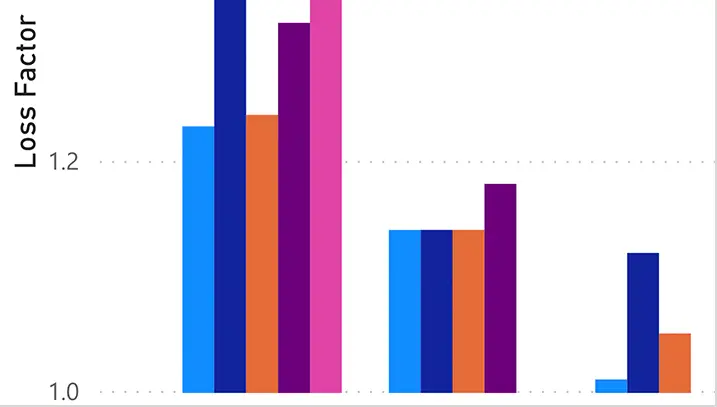

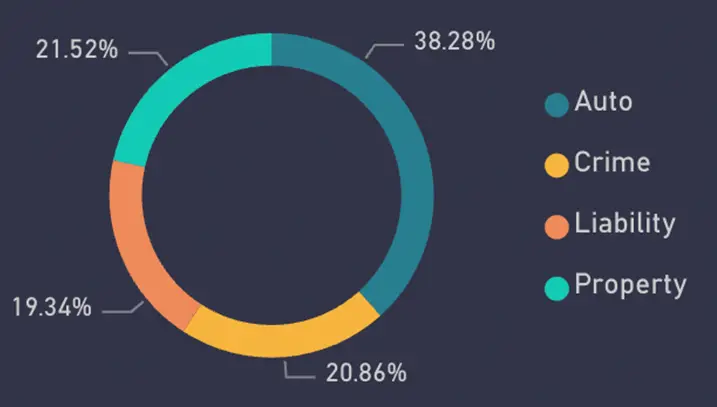

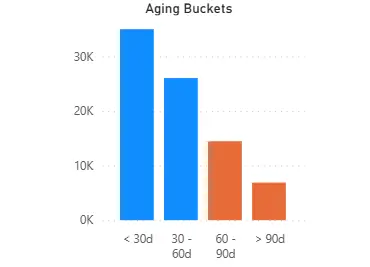

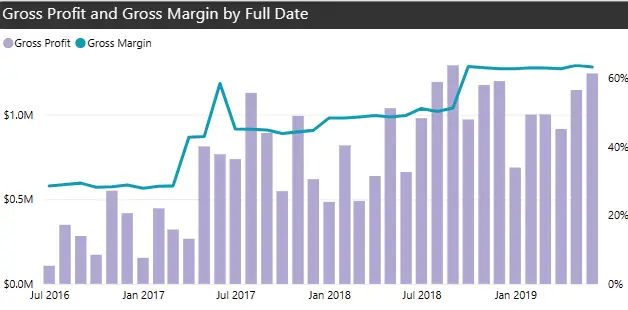

Whether your priority is retaining loanees, reducing defaults, or ensuring compliance, we can create flexible, interactive dashboards that give you data-driven insights at your fingertips. It’s simple: You define them. We create them.

Here’s a look at some examples of our interactive dashboards:

Ready to get more out of your financial data?

Information powers business success. But to access and understand that information, you need financial analytics consulting to bring it to light.

LeapFrogBI is ready to support you with financial analytics consulting and reporting so you can uncover the business power that lies within your financial data.

Reserve a free, 30-minute consultation to learn how our analytics services support banking and financial services.

Is your data ready to work for you in a high interest rate environment?

Read our blog post:

Trusted by the Best in their Industries

FAQS

Our clients typically see 10x ROI within 6 months. To best predict your potential ROI, start by clarifying your goals: Do you want to reduce expenses or increase revenue? Before you can begin calculating ROI, you need to determine which business process(es) you want to improve with data analytics. Learn more on determining data analytics’ ROI on the podcast, More Than Reports

For financial reporting and analytics consulting, we supply development software, including our automation platform, to deliver reports that are automatically produced, updated, and available at your fingertips. Our proven methodology for data analytics is faster and lower risk than traditional approaches. Combined with our deep business intelligence experience, our financial analytics consultants maximize efficiency for banking leaders.

Our financial analytics consultants work as an extension of your company, scaling up or down as your needs change. This means that after the implementation phase, you can count on us to continue working closely with your company, whenever you need it. We believe business intelligence is a business function—not a one-and-done project. In other words, we get to know your business challenges and continue to provide ongoing data solutions as you grow and scale.